|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Places to Refinance a Home: An Informative GuideRefinancing your home can be a strategic move to lower interest rates, reduce monthly payments, or access your home equity. Choosing the right lender is crucial for a smooth and beneficial refinancing experience. Here, we explore some of the best places to refinance a home and what you should consider when making your decision. Understanding Home RefinancingBefore diving into where to refinance, it's important to understand what refinancing involves. When you refinance, you replace your existing mortgage with a new one, often with better terms. Benefits of Refinancing

Types of Refinancing

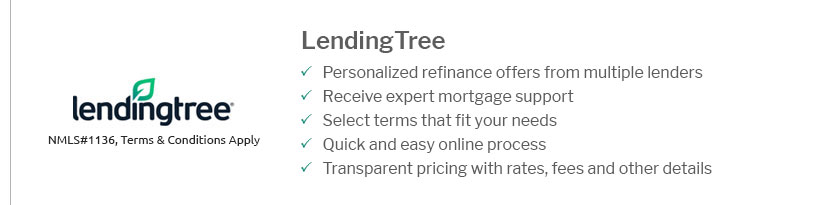

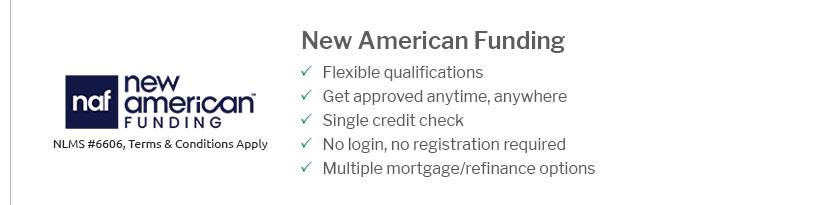

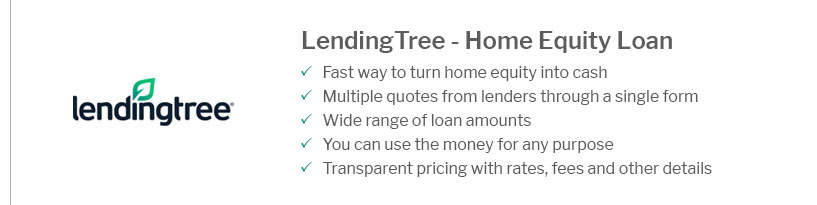

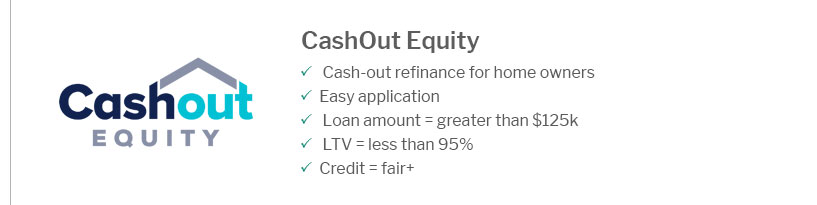

Top Lenders for Home RefinancingChoosing the right lender is key. Here are some top options for refinancing your home: Traditional BanksMany large banks offer refinancing options, providing reliability and a wide range of services. Credit UnionsCredit unions often offer competitive rates and personalized service. They can be an excellent choice if you’re already a member or eligible to join one. Online LendersOnline lenders provide convenience and often offer lower fees. Their digital platforms make the application process quick and straightforward. For those interested in FHA loans, it’s worth exploring banks that offer FHA streamline refinance to potentially benefit from faster processing times. Special Considerations for RefinancingBefore deciding where to refinance, consider these factors:

If your home is facing financial difficulties, some banks that refinance homes in foreclosure may offer solutions to help you keep your property. Frequently Asked QuestionsWhat is the best time to refinance a home?The best time to refinance is when interest rates are lower than your current mortgage rate, or when you want to change your loan terms to better suit your financial situation. How do I qualify for refinancing?To qualify for refinancing, you typically need a good credit score, sufficient home equity, and a stable income. Lenders will assess your financial health to determine eligibility. Are there any risks involved in refinancing?Yes, there are risks, such as resetting the loan term, which can lead to paying more interest over time, and incurring closing costs that may negate the savings from a lower interest rate. Staying informed and carefully evaluating your options can help you make the best refinancing decision for your home. https://money.com/mortgage-refinance/

Mortgage Lenders - Mortgage Refinance - Mortgage Rates - Home Equity Loans ... https://www.wellsfargo.com/mortgage/mortgage-refinance/

A simplified online application makes it easier to apply for a mortgage refinance with Wells Fargo. Use our refinance calculator to find your rate. https://www.investopedia.com/home-lenders-offering-buy-now-refinance-later-6889362

Flyhomes will soon launch a deal covering all refinance closing costs, including third-party fees.5; Guild Mortgage will waive lender fees only.

|

|---|